Title Deed in Dubai: Verification, Transfer & Fees

In Dubai, the Title Deed is the official document issued by the Dubai Land Department (DLD) that confirms legal ownership of a property. It is essential for all real estate transactions under Law No. 7 of 2006 Concerning Real Property Registration in the Emirate of Dubai.

In 2024, Dubai’s real estate sector recorded AED 761 billion in transactions, per DLD figures; early 2025 data indicates continued growth, supported by digital innovations such as the blockchain-based registry launched this year for secure ownership records.

This guide covers the legal framework, types of Title Deeds, issuance and transfer processes, verification, fees, and common issues, with updates for 2025. All procedures can be handled efficiently through EGSH, an authorised Real Estate Services Trustee Centre.

Title Deed Services at EGSH

What Is a Title Deed in Dubai?

A Title Deed, commonly referred to as 'Mulkiya' in Arabic, is an electronic certificate issued by the DLD that identifies the owner, the property, and the ownership rights.

Many property-related procedures require a No Objection Certificate in the UAE to confirm there are no legal or financial restrictions on the asset.

It states the owner’s full name, the Title Deed number, a description of the property (unit/plot, area, location), the property type (apartment, villa, land), any relevant map or plot reference, the nature of ownership (freehold, leasehold, usufruct, musataha), and the issue date.

Deeds are issued digitally with an official electronic seal and are legally equivalent to paper documents for courts, banks, and government authorities. If access is lost, the electronic Title Deed can be reissued through DLD or via a Trustee Centre.

Legal Basis for Title Deeds in Dubai

The legal framework for property ownership in Dubai is established by Law No. 7 of 2006 Concerning Real Property Registration in the Emirate of Dubai. Under this law, the Dubai Land Department (DLD) is the sole authority responsible for maintaining the real property register and issuing Title Deeds.

Ownership rights differ depending on nationality: UAE and GCC nationals may own property across the emirate without restriction, while foreign investors are permitted to acquire freehold ownership only in designated areas approved by the Ruler of Dubai.

All property dispositions – such as sales, gifts, inheritance transfers, and long-term leases – must be registered with the DLD to be legally enforceable. Once recorded, these transactions are reflected in the Title Deed, which serves as official proof of ownership.

Dubai’s move toward digital governance is supported by electronic transactions legislation that gives electronic Title Deeds the same legal validity as paper certificates. Court judgments and probate orders affecting ownership also become effective only after registration with the DLD and inclusion in the official property record.

In specific ownership-change cases connected to government grants, the file may also require a Grant completion application in Dubai before the new ownership entry can be finalised in the DLD register.

What Information Does a Title Deed Contain?

The deed records who owns the property and what precisely is owned. Beyond core identifiers (owner, deed number, property particulars), the electronic certificate bears a digital signature that allows any party to confirm authenticity. Because the deed mirrors the DLD register, banks and courts treat it as conclusive proof of ownership unless and until amended.

Get DLD Services in Dubai Through EGSH

Authorised One-Stop Government Services Centre

- All government services in one place

- Completed in one visit

- VIP service without queues

- Regulated government fees

Types of Title Deeds in Dubai

The type of Title Deed in Dubai depends on the nature of the ownership right registered. Understanding these distinctions is essential, as they determine the scope of an owner’s legal authority over the property—whether full ownership, long-term use, or development rights.

Freehold Title Deed

This deed grants full ownership of the property and, where applicable, the underlying land. It allows the owner to sell, lease, mortgage, or bequeath the property freely within areas designated for freehold ownership. Freehold rights are available to UAE and GCC nationals throughout Dubai and to foreign investors in specific zones approved by the Ruler of Dubai.

Leasehold Title Deed

A leasehold deed records the right to use and occupy a property for a defined term — typically up to 99 years — without owning the land itself. It sets out the lease duration, property details, and the lessee’s rights and obligations. Such deeds are common in mixed-use or master-planned developments.

Usufruct and Musataha Title Deeds

These deeds grant long-term real estate rights for use or development under agreed conditions. A usufruct allows the holder to benefit from the property without altering its substance, while a musataha authorises construction or development on another’s land. Both are widely used in commercial projects and public–private partnerships.

Off-Plan (Pre-Title) Registration

For properties under construction, buyers receive an Oqood certificate—a pre title deed Dubai record of ownership in the DLD system. When the project is completed and handed over, this Oqood is converted into a formal Title Deed in the buyer’s name.

Why Choose EGSH for Title Deed Services

VIP Service

Personal assistance and priority processing with no queues.

Affordable Fees

Official government rates with transparent, fixed pricing.

All Services in One Place

Comprehensive range of UAE government services under one roof.

One-Visit Completion

Most procedures are completed in a single visit to the centre.

Why the Title Deed Is Important

The Title Deed is the definitive legal instrument of property ownership in Dubai. In practice, the document performs three essential legal and procedural functions:

1. Establishing ownership rights

The Title Deed serves as conclusive proof of ownership and is the only document recognised by Dubai Courts, government authorities, and financial institutions as evidence of legal title. All rights and obligations attached to the property — including use, transfer, mortgage, inheritance, or leasing — are derived from the registration reflected in the DLD record.

2. Ensuring legal enforceability of transactions

Under UAE law, any disposition of real property – such as a sale, gift, or long-term lease – is enforceable only once it is registered with the DLD and reflected in the Title Deed. Without registration, private agreements have no legal effect against third parties, regardless of the amounts paid or contracts signed.

3. Enabling government and financial procedures

The Title Deed is a prerequisite for key processes linked to property ownership: mortgage registration, property valuation, succession and probate registration, insurance, and obtaining residence visas based on property investment. Banks and authorities rely exclusively on verified DLD records when assessing ownership or collateral.

Therefore, possession of a valid, accurately issued Title Deed safeguards ownership rights and transactional security. It protects buyers, sellers, and lenders by ensuring that property transfers are transparent, legally binding, and recorded in the official register maintained by the Dubai Land Department.

How to Obtain a Title Deed in Dubai

Title deed issuance is the final step in registering property ownership and making it legally effective under the UAE law. The procedure differs depending on whether the property is being registered for the first time after handover from a developer, or whether ownership is being transferred from an existing owner on the secondary market.

In all cases, the Dubai Land Department (DLD) verifies the file, collects the applicable fees, and issues the electronic Title Deed to the new or updated owner once the registration is complete.

Purchase from a Developer (Off-Plan or Ready Property)

For new developments, buyers initially receive an Oqood certificate, which records their contractual ownership rights during construction. Once the project is completed and handed over, the Oqood must be converted into a formal Title Deed to establish full legal ownership.

Procedure:

- The developer submits the project completion certificate and registration to DLD.

- The buyer receives the handover set from the developer, which includes payment confirmations and a no-objection certificate (NOC).

- The buyer or their authorised representative visits DLD or a Real Estate Services Trustee Centre to file the issuance request.

- Trustee Centre verifies the documentation, checks that the project and buyer details correspond in the DLD system, and collects the applicable government fees.

- Upon approval, DLD sends the electronic Title Deed to the buyer via secure email.

This registration converts a contractual right into a registered ownership right recognised by Dubai Courts, banks, and government entities. Without this conversion, the buyer remains only a contractual holder under the developer’s register.

Purchase on the Secondary Market (Title Deed Transfer)

When a property is resold, the process involves transferring ownership from the seller to the buyer and issuing a new Title Deed. The DLD cancels the seller’s existing deed and records the buyer as the new owner in the real property register. This Property transfer procedure in Dubai is completed only after the transaction is entered into the DLD register and the new electronic Title Deed is issued to the buyer.

Procedure:

- The buyer and seller sign a Sale and Purchase Agreement (SPA) and agree on settlement terms.

- The parties submit the SPA and required documents to DLD or a Trustee Centre.

- EGSH conducts pre-submission verification to ensure that the Title Deed, ID, and property data match the DLD record and that there are no outstanding liabilities (mortgage, service fees, or developer restrictions).

- Government fees and applicable map charges are paid through secure channels at the centre.

- Once approved, DLD cancels the previous deed and issues a new electronic Title Deed in the buyer’s name.

The new deed is the only legally valid record of ownership. Any previous agreements or private receipts are superseded once registration is complete.

The Title Deed Transfer is the act of registration through which ownership rights formally pass to the buyer. It extinguishes the seller’s legal title and replaces it with a new entry in the DLD register.

This step provides legal certainty—without it, the buyer has no enforceable ownership right, even if full payment has been made.

Visit EGSH for VIP Service Without Queues

You can stop by EGSH during working hours without an appointment or book your visit at a time that suits you best.

Address

Art of Living Mall, Al Barsha 2, Dubai

Operating hours

Monday–Thursday, Saturday: 9:00 am–3:00 pm

Friday: 9:00 am–12:30 pm

Sunday: Closed

Documents Required for Title Deed Procedures

Before the Dubai Land Department (DLD) issues, transfers, or updates a Title Deed, a complete and verified set of documents must be submitted to confirm ownership, identity, and property eligibility for registration.

The document requirements differ based on the nature of the service, and depending on whether the case involves first-time issuance, ownership transfer, or amendment to an existing record.

In specific identity or special-category cases, the file may also require a DLD to whom it may concern certificate to support authority or status confirmation in the DLD system.

Title Deed Issuance (After Property Handover)

This procedure applies when registering a new property for the first time after project completion. It finalises the buyer’s ownership and replaces the interim Oqood record with a permanent Title Deed.

Required documents:

- Copy of the owner’s Emirates ID

- Copy of the existing Title Deed (if reissued or replaced)

Developer handover documents, including:

- No-Objection Certificate (NOC) confirming full settlement

- Unit handover or completion certificate

- Clearance of all service or maintenance fees

In some cases, DLD officers may request additional documentation — such as the sale and purchase agreement (SPA) or payment receipts — to verify the transaction and ensure that all obligations have been met before issuing the deed.

Title Deed Transfer (Sale, Gift, Inheritance, or Corporate Transfer)

A Title Deed transfer is the process by which ownership is legally moved from one party to another. It may result from a sale, a registered gift between relatives, an inheritance, or a change in corporate ownership. The submitted file must confirm both parties’ legal authority and that the property is eligible for transfer.

Required Documents:

- Letter from the transferor confirming the transfer request.

- Emirates ID of the owner, or a Power of Attorney (POA) if represented

- Passport copies for non-resident owners.

- Trade licence and corporate authorisation documents (if applicable).

- Bank clearance certificate in cases of an existing mortgage.

- Property map issued by DLD or Dubai Municipality confirming the boundaries and area.

Each document must match the DLD register to ensure that the transfer is legally valid and enforceable.

Title Deed Update (Amendment to Existing Record)

Title Deeds may require updating when ownership details or property characteristics change. Common amendments include correcting personal data, adding new parking allocations, revising unit area after a re-survey, or reflecting legal changes such as inheritance distribution.

Required Documents:

- Emirates ID of the owner or authorised representative.

- Passport copy for non-resident owners.

- Official supporting letter or approved map confirming the change, for example:

- Municipality or DLD letter approving an area adjustment.

- Updated cadastral map or site plan.

- Court or administrative document supporting a name or ownership change.

After review, DLD issues an updated electronic Title Deed reflecting the new information, which replaces the previous version in the official register.

How to Verify a Title Deed in Dubai

Title Deed verification in Dubai is a formal procedure conducted through the Dubai Land Department (DLD) to confirm that a property ownership certificate is genuine, valid, and registered in the official system.

In due diligence workflows, a property status inquiry is also used to confirm the current standing of the property record (restrictions, linked notes, and registration status) before proceeding with sale, mortgage, or succession steps.

Verification safeguards individuals and institutions against fraudulent transactions and ensures that all dealings are based on legally recorded ownership data.

This process is mandatory in several scenarios — before property transfers, mortgage applications, inheritance registrations, and legal disputes — as it confirms that the property and owner details correspond precisely with the DLD register.

When Title Deed Verification Is Required

Verification is used whenever an official record must confirm property ownership.

Typical situations include:

- Before sale or purchase, buyers and their representatives verify the seller’s Title Deed before signing the sale and purchase agreement to confirm that the seller is the lawful owner.

- For mortgage and financing. Banks require a verified Title Deed before approving a loan, conducting a valuation, or registering collateral.

- During inheritance or court proceedings. Courts and notaries rely on verified deeds when adjudicating succession, probate, or enforcement matters.

- For corporate and investment transactions. Companies, developers, and investors include DLD verification results in due diligence reports and ownership audits.

Verification is not only a matter of caution—it is a legal due diligence step that supports the enforceability of contracts and protects parties against potential claims or title defects.

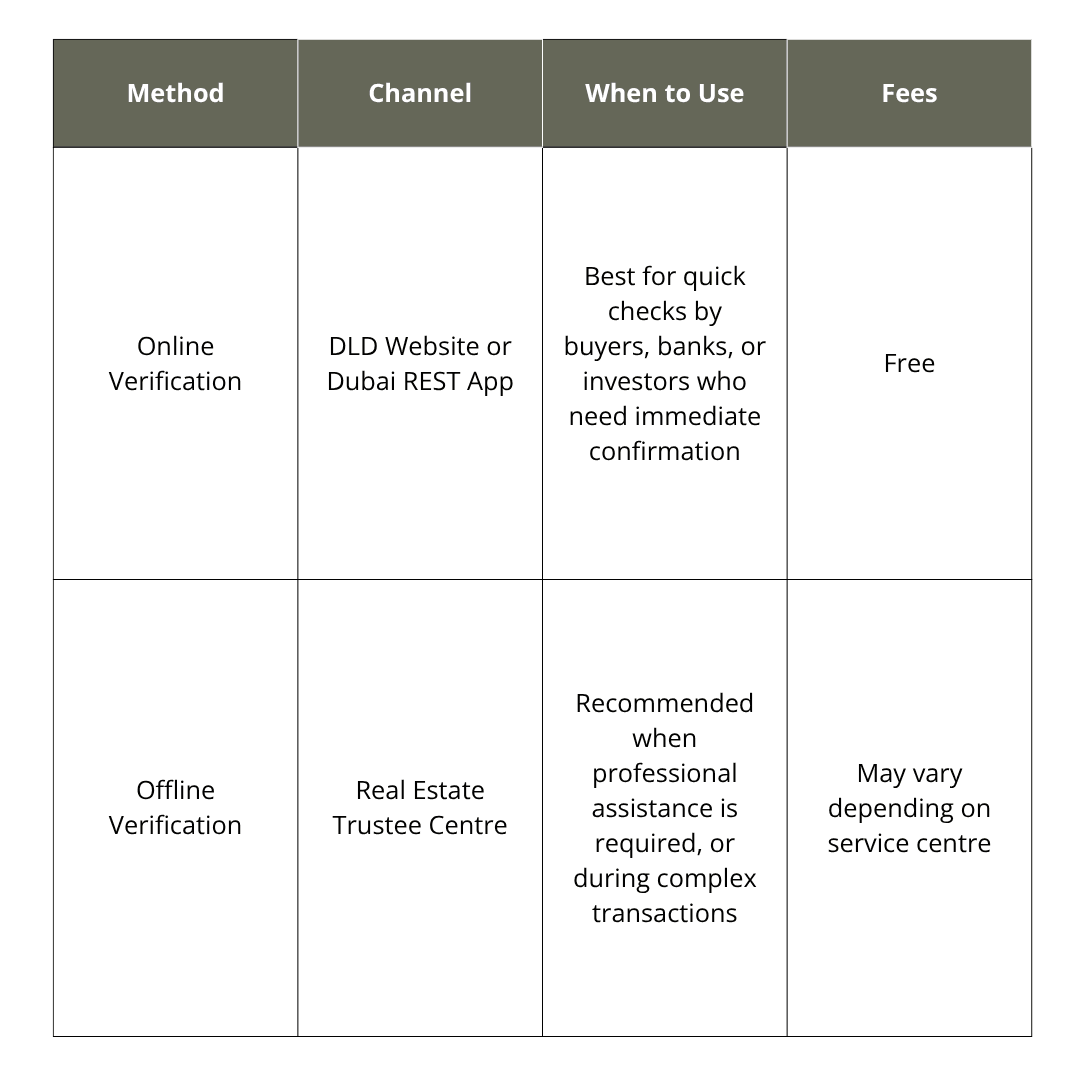

Verification Methods and Channels

There are two official channels for verifying a Title Deed in Dubai.

Online Verification

Accessible via the DLD website or the Dubai REST mobile application (iOS/Android).

- The applicant enters the Title Deed number in the designated verification field.

- The system retrieves the ownership data directly from the DLD register and displays the result instantly.

- The output can be downloaded or printed as a reference document.

This method is recommended for quick checks by buyers, agents, banks, or investors.

In-Person Verification at a Real Estate Services Trustee Centre

Suitable for complex or high-value transactions, inheritance cases, or where supporting identification must be cross-checked.

- The applicant provides the Title Deed number, along with identification (Emirates ID for residents, passport for non-residents).

- If a representative makes the request, a valid Power of Attorney (POA) must also be presented.

- The trade licence and proof of authority are required for corporate entities.

- The officer confirms the record within the DLD system in the applicant’s presence and issues the verification output.

Both channels are directly connected to the DLD property register, ensuring that the results have full evidentiary value.

Information Displayed in the Verification Result

The verification result reproduces key details from the official DLD database, including:

- Title Deed number and issue date.

- Property type (villa, apartment, land, etc.).

- Location and community name.

- Unit or plot number and total area.

- Registered owner’s name.

- Ownership status (active, transferred, or replaced).

These details allow any party to confirm that the document presented matches the official record maintained by the Dubai Land Department.

Recognising Irregularities and Suspected Forgery

A genuine Title Deed always corresponds precisely with the DLD verification result.

If any element of the physical or electronic document — such as the owner’s name, property number, or area size — differs from the official record, the deed should be considered suspect.

Common indicators of irregularities include:

- “Not Found” result in the DLD system despite the document appearing authentic.

- Mismatched property details or ownership data.

- Incorrect issue date or reference number.

In such cases, the party should request verification in person at a Trustee Centre to confirm the document’s authenticity through direct access to the DLD database.

Result Statuses and Their Meaning

Each verification generates a specific status reflecting the standing of the property record in the DLD system:

- Valid – The Title Deed is genuine, current, and active in the DLD register.

- Expired / Replaced – The record has been superseded by a new Title Deed following a transfer or amendment.

- Not Found – No record matches the entered details. This may indicate an input error or a forged or cancelled document.

The verification output can be downloaded as a PDF and used as supporting evidence in property transactions, financing applications, or legal proceedings.

Legal Effect of Verification Results

Because verification data is drawn directly from the official DLD register, it carries full legal weight.

Banks, notaries, and courts accept verified Title Deed information as conclusive proof of ownership. In real estate transactions, attaching a copy of the verification output to the sale file has become standard practice to demonstrate due diligence and protect against title disputes.

Verification, therefore, serves as a risk-prevention measure and an official validation step, confirming that the property exists in the DLD system, that ownership is accurately recorded, and that the document presented corresponds to the registered legal reality.

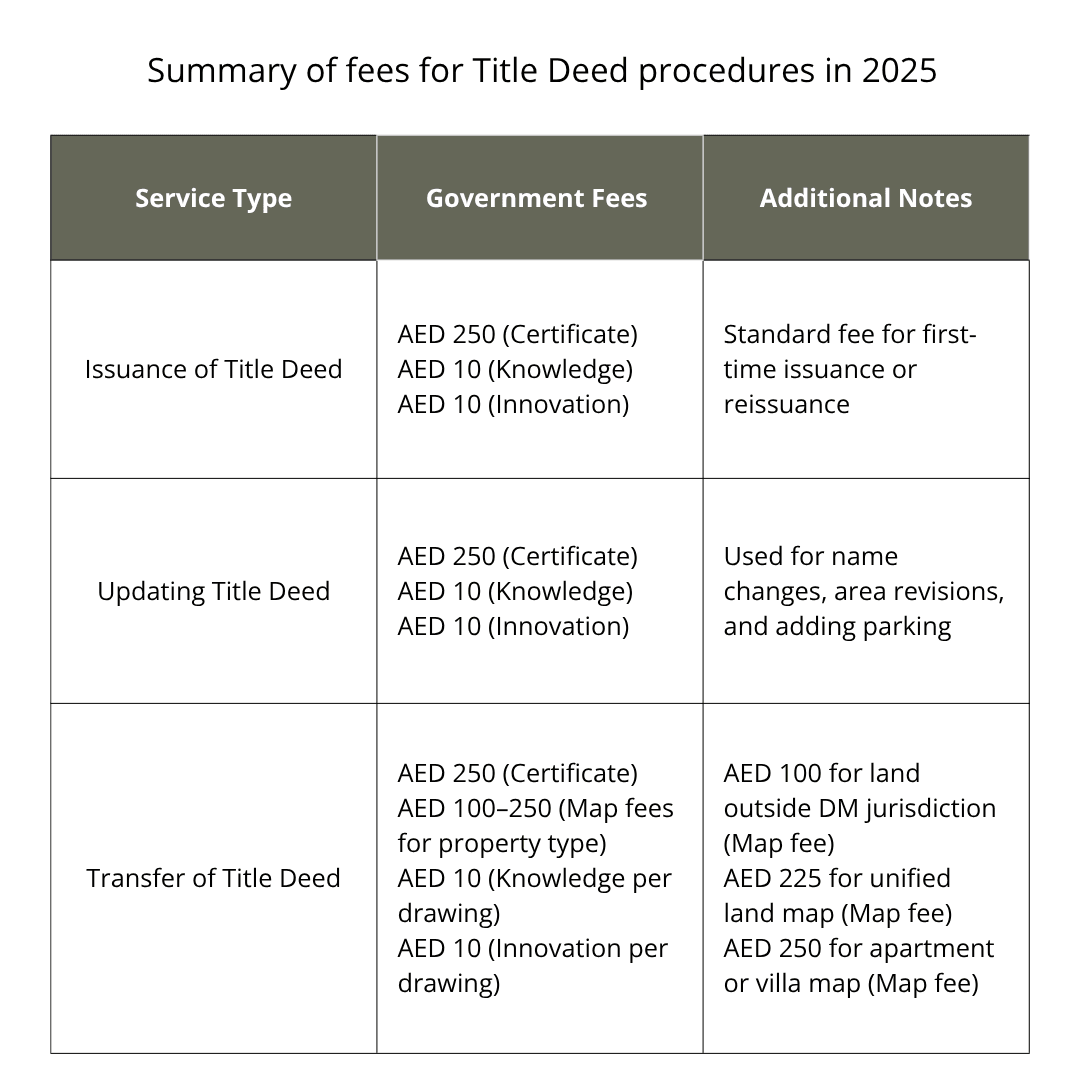

Title Deed Fees & Costs in Dubai

For transfers and new registrations, property map issuance Dubai is often required to attach the correct cadastral plan to the Title Deed file and avoid boundary or area disputes. The Dubai Land Department (DLD) applies standard government fees for all Title Deed services, including issuance, updates, and transfers of ownership.

These charges are set under the DLD’s unified fee schedule and cover the cost of preparing, verifying, and recording ownership data in the official real property register.

All fees are payable through authorised DLD channels or Real Estate Services Trustee Centres, where payments can be made in cash, by cheque, card, or ePay. Official receipts are issued immediately upon payment.

Fees for Title Deed Issuance and Update (2025)

The same fee applies whether a Title Deed is being issued for the first time or updated to reflect amended information such as owner name, property area, or parking details.

- Certificate fee: AED 250

- Knowledge fee: AED 10

- Innovation fee: AED 10

These charges apply per certificate issued and are fixed across all categories of real estate.

Fees for Title Deed Transfer (2025)

When ownership is transferred — through sale, inheritance, or gifting — the DLD applies the certificate fee and an additional charge for property maps attached to the Title Deed.

These maps form part of the official record and are used to define the exact boundaries, dimensions, and physical characteristics of the property.

- Certificate fee: AED 250.

- Knowledge fee (per drawing): AED 10.

- Innovation fee (per drawing): AED 10.

- Map fee: variable, depending on property type and jurisdiction.

Property Map Fees (2025)

A property map (also referred to as a cadastral or site map) is an official plan issued by the DLD or Dubai Municipality confirming the location, plot boundaries, area, and dimensions of a unit, villa, or land parcel.

The map is an integral part of the property record and is attached to the Title Deed when a transfer or new registration takes place.

Typical map fees are as follows:

- Land map outside the Dubai Municipality jurisdiction. Required for plots located outside the administrative areas governed by Dubai Municipality. Map fee: AED 100.

- Unified land map. Used when DLD and Dubai Municipality jointly verify and approve the land boundaries. Map fee: AED 225.

- Apartment or villa map. Applies to built properties to record the unit layout and floor area. Map fee: AED 250.

The DLD determines which map type applies based on the nature and location of the property.

In transfers and new registrations, attaching the correct map ensures that the legal record precisely reflects the property’s physical attributes, avoiding future boundary or ownership disputes.

All Title Deed and map fees must be settled at the time of submission. Payments are accepted directly at DLD counters or through Real Estate Services Trustee Centres, with immediate confirmation through the DLD system.

Visit EGSH for VIP Service Without Queues

You can stop by EGSH during working hours without an appointment or book your visit at a time that suits you best.

Address

Art of Living Mall, Al Barsha 2, Dubai

Operating hours

Monday–Thursday, Saturday: 9:00 am–3:00 pm

Friday: 9:00 am–12:30 pm

Sunday: Closed

Processing Time for Title Deed Services

The DLD maintains clear service standards for all Title Deed procedures to ensure the efficiency and transparency of property registration in the emirate.

When all required documents are complete and the application is correctly filed, most Title Deed transactions are processed on the same working day.

The following are the official DLD average timeframes for key services:

- Title Deed issuance: approximately 25 minutes

- Title Deed update: approximately 25 minutes

- Title Deed transfer: 25–30 minutes

- Title Deed verification: immediate (real-time system output)

These timeframes reflect the period required by DLD officers to verify the documents, confirm payment, and record the transaction in the official real property register.

Electronic deeds are issued automatically upon approval and sent to the registered owner via secure email.

Factors That May Extend the Processing Period

While DLD procedures are designed for same-day completion, additional verifications may extend the total processing time in some cases.

Typical reasons include:

- Incomplete or inconsistent documentation, such as unmatched Emirates ID or POA details.

- Pending developer clearance or outstanding service fee confirmations.

- Mortgage-related approvals, including bank release or loan settlement.

- Power of Attorney (POA) verification is required if executed abroad and requires attestation.

- Complex property configurations, such as subdivided plots or multi-unit developments, requiring updated maps.

Once these requirements are resolved, the DLD finalises the registration and issues the electronic Title Deed immediately.

Title Deed for Non-Residents and Foreign Buyers

Property ownership in Dubai is open to UAE residents and foreign investors. However, the rights and procedural requirements for obtaining a Title Deed vary depending on the purchaser’s residency status and the property’s location within the emirate.

Eligibility of Non-Residents

Foreign nationals who do not hold a UAE residence visa are permitted to own property and obtain a Title Deed in special areas officially designated for freehold ownership by the Ruler of Dubai.

These zones, known as freehold zones, include significant residential and mixed-use developments such as Dubai Marina, Palm Jumeirah, Downtown Dubai, and Dubai Islands, and are open to non-resident individuals and corporate entities.

A Title Deed issued to a non-resident carries the same format, legal validity, and evidentiary force as those issued to UAE or GCC nationals.

It certifies absolute ownership of the unit or land within the designated freehold area and grants the holder the right to:

- Sell or purchase the property freely.

- Lease it to third parties.

- Mortgage or finance the property with an approved UAE bank.

- Bequeath or transfer ownership in accordance with UAE inheritance laws.

Besides these designated freehold zones, property ownership remains restricted to UAE and GCC nationals or companies wholly owned by them.

Obtaining a Title Deed from Outside the UAE

Non-resident owners who are not physically present in the UAE may complete all Title Deed procedures — including issuance, transfer, or amendment — through an authorised representative acting under a legally attested Power of Attorney (POA).

The POA must follow UAE attestation standards:

- Notarisation in the country of origin.

- Attestation by the UAE Embassy or Consulate in that country.

- Legalisation by the UAE Ministry of Foreign Affairs (MOFA).

Once attested and verified, the document empowers the authorised representative to complete official tasks for the owner — such as submitting applications, signing documents, or finalising procedures — at the Dubai Land Department (DLD) or an accredited Real Estate Services Trustee Centre to complete property registration on the owner's behalf.

Key Procedural Notes for Non-Residents

Electronic Issuance: All Title Deeds are issued in digital format and delivered via secure email. The electronic certificate has full legal validity and may be used in all official transactions.

Recognition by Courts and Authorities: Non-resident Title Deeds are accepted by Dubai Courts, notaries, and government entities for inheritance registration, resale, or financing.

Financing and Visa Considerations: Some mortgage and residence-visa categories based on property ownership may require additional documentation, such as property valuation, insurance, or proof of minimum property value.

Therefore, foreign investors enjoy secure and legally recognised ownership rights in Dubai, provided that the property is purchased within designated freehold areas and all registration procedures are completed in accordance with DLD regulations.

Common Issues with Title Deeds

Although the Dubai Land Department maintains a highly reliable and digitised property registration system, some issues may still arise during or after the issuance of a Title Deed.

Most problems result from discrepancies in documentation, incomplete registrations, or changes in ownership data that have not yet been reflected in the DLD register.

Incorrect or Incomplete Owner Information

Errors in the spelling of names, ID numbers, or ownership percentages occasionally occur when documents are submitted with inconsistent personal data.

Such discrepancies can cause complications when selling the property, applying for a mortgage, or presenting the Title Deed in court or before a notary.

Resolution:

The owner must request a Title Deed amendment through the DLD or an authorised Trustee Centre.

The application is accompanied by the correct Emirates ID, passport, or corporate licence to verify the proper ownership details.

Once approved, DLD issues a revised electronic Title Deed that replaces the previous version in the system.

Lost or Inaccessible Electronic Title Deed

Since all Title Deeds are now issued electronically, losing the original download link or access credentials may prevent an owner from retrieving the certificate when needed for banking, resale, or legal use.

Resolution:

Owners can request a reissuance of the electronic Title Deed through DLD’s e-services or by visiting a Trustee Centre.

After identity verification, a new secure link is generated and sent to the registered email address, restoring access to the document.

Outdated Property Details

If the property has been re-surveyed, subdivided, or expanded — for example, when additional parking spaces are purchased or the total area is adjusted — the existing Title Deed may no longer reflect the property’s accurate physical description.

Resolution:

An update request must be filed with DLD together with the new approved property map or an official letter confirming the revised area or layout.

The department then issues an updated electronic deed reflecting the current specifications.

Unregistered Inheritance or Gift Transfers

Ownership changes resulting from inheritance, court rulings, or gifts are not legally effective against third parties until they are recorded with DLD and a new Title Deed is issued.

If heirs or beneficiaries fail to complete registration, future sales, financing, or utility connections may be delayed or rejected.

Resolution:

The new owners must submit the relevant court judgment, inheritance certificate, or gift documentation to DLD for registration.

Upon approval, a new Title Deed is issued in the rightful owner’s name, ensuring that the transfer is recognised in the official register.

Court Judgments or Power of Attorney Transfers Not Reflected

In some cases, ownership transfers authorised by court orders or valid Powers of Attorney (POA) remain unregistered in the DLD system.

Although such transactions may be legally valid, they are not enforceable until entered in the official property register.

Resolution:

The relevant court judgment or POA must be submitted to the DLD so the property register can be updated and amended to reflect the change in ownership officially.

Once the supporting documents are verified, DLD updates the ownership data and issues a new electronic Title Deed confirming the transfer.

Maintaining Accuracy and Legal Validity

To avoid administrative or legal complications, property owners are advised to:

- Ensure all personal and property data are correct before submission.

- Keep secure copies of all electronic Title Deeds and correspondence.

- Update the DLD record promptly after any change in ownership or property details.

- Register all inheritance, gift, or court-related ownership changes without delay.

Regular verification and timely updates help maintain a clear and accurate property record, protecting ownership rights and ensuring full legal enforceability in Dubai’s real estate system.

How EGSH Simplifies Title Deed Services

EGSH is an officially authorised UAE government services centre integrated with the systems of the Dubai Land Department (DLD). It provides a centralised environment for completing all procedures related to property registration — including the issuance, transfer, verification, and amendment of Title Deeds — in full compliance with DLD regulations.

By consolidating multiple government services under one roof, EGSH allows clients to complete the entire Title Deed process efficiently and securely, without the need to visit multiple departments.

Before submission, all documentation is reviewed for accuracy to avoid rejections or delays. Applications are entered directly into the DLD system by authorised representatives, and payments are processed through secure channels on-site.

This structured approach ensures legal precision at every stage—from verifying ownership and identity details to confirming settlement with the developer or bank.

Clients benefit from a transparent process, multilingual assistance, and, where required, coordination with related authorities such as Dubai Courts or DEWA.

EGSH focuses on compliance, accuracy, and speed, ensuring that each Title Deed issued through its system is legally valid, digitally verified, and recognised by the Dubai Land Department.

How a Title Deed Service Works in Practice

To illustrate the process, consider the case of a resident expatriate who has completed the final payment for a newly built apartment in Dubai. The next legal step is to obtain the Title Deed confirming ownership.

The client visits EGSH, where the consultant reviews the required documents — the Emirates ID, the developer’s handover and completion certificates, and proof of payment — and confirms that all data matches the DLD system. Once verified, the application is submitted electronically through the official DLD registration platform.

The government fees are paid at EGSH using secure channels, and the DLD officer immediately reviews the transaction. Within approximately 25 minutes, the buyer receives an email containing the official electronic Title Deed, establishing full legal ownership of the property.

Conclusions

The Dubai Title Deed is the cornerstone of property ownership and the legal foundation for every real estate transaction in the emirate.

Whether registering a new property, transferring ownership, or updating existing records, following the official DLD process ensures that ownership rights are properly recorded, protected, and enforceable under UAE law.

As Dubai’s property market continues to expand, accurate and verified registration has become essential for legal compliance and investor security.

EGSH provides authorised assistance for all related DLD services. All services are completed under one roof at EGSH, ensuring efficient, compliant, and secure registration for residents and foreign investors.

*This guide provides general information about Title Deeds in Dubai as of October 2025. Requirements and fees may change. Always verify the current information with the Dubai Land Department or EGSH and your chosen financial institution. This article does not constitute financial or legal advice.